In this year I made major adjustments on my investment approach. I made this change because of the painful experience of losing a lot of money in 2022. And I realized that life has a lot more to offer than constantly checking on the positions I hold and trade them multiple times per month.

I got sucked into the idea that trading is the better way to make it big in the stock market. As a trader in the Philippines, I never thought of tax implications that come with trading equities. It’s a very different experience in the US. There are rules that are set in place so that you, as a regular investor, can’t rig the system. In 2022, I almost blew my account by being bullish on a bear market. To add fuel to the fire, I was hit by a tax bill end of the year. It took me a long time to recover, I had to undergo a lot of unlearning and re-learning on my investment approach.

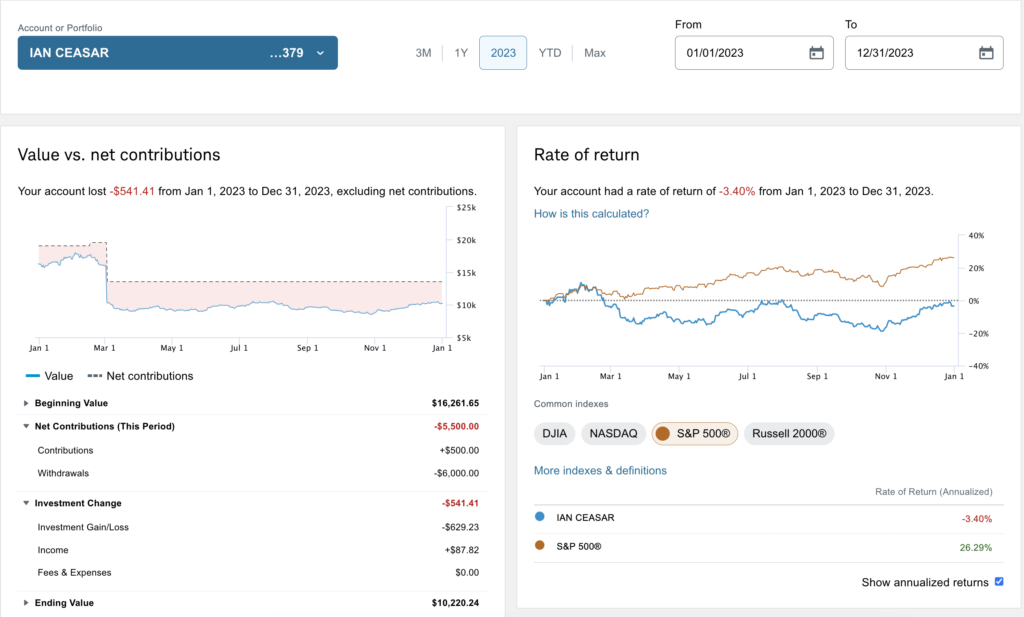

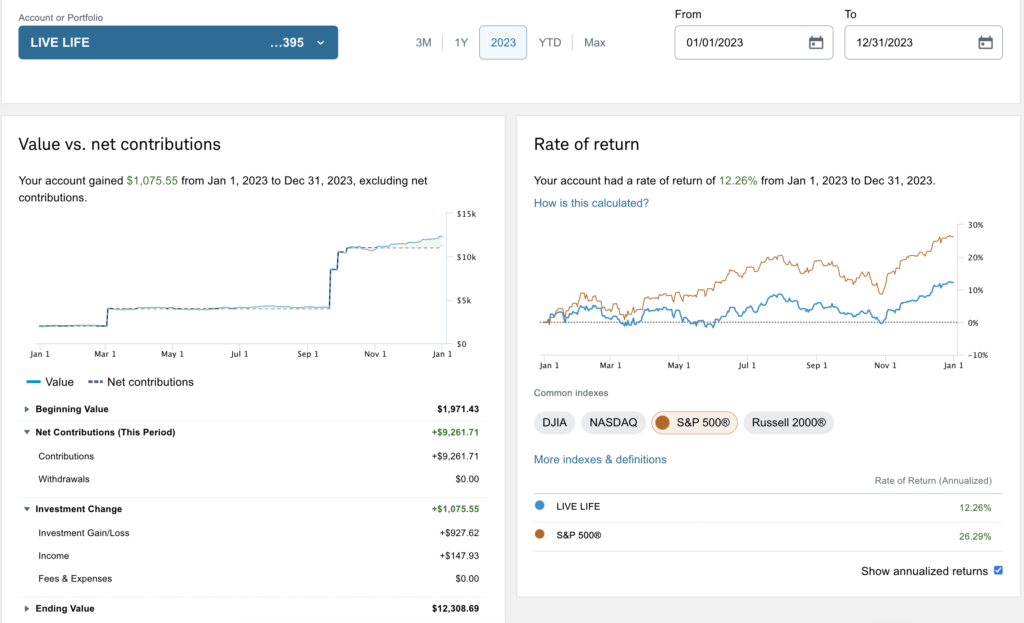

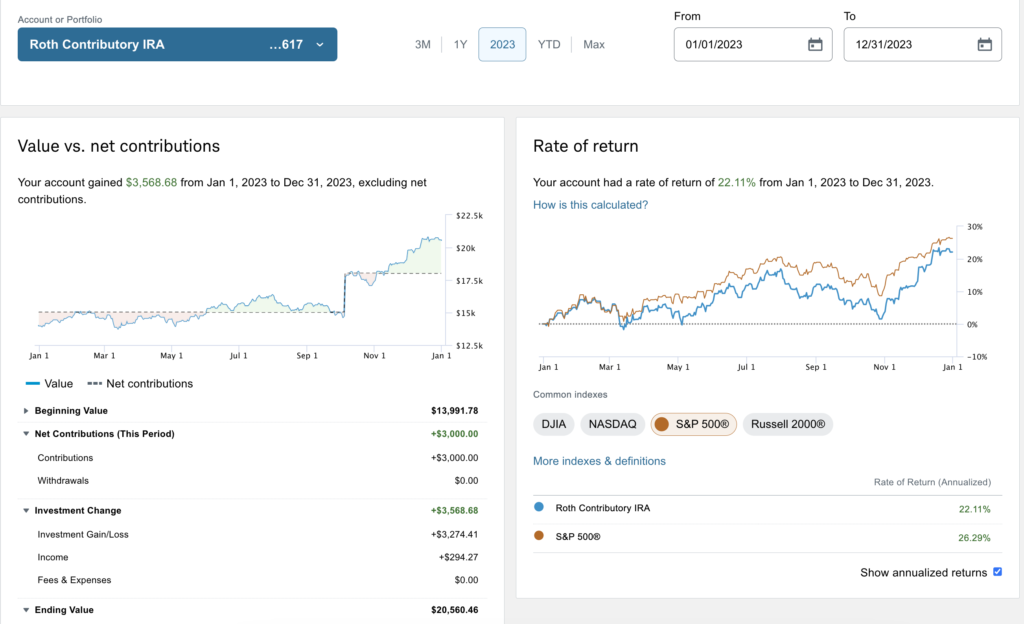

What I first did was to consolidate my investments into a single platform, Charles Schwab. I then created a long-term portfolio where I plan to hold “Compounders” with the goal of outperforming the S&P500 year over year. Aside from that portfolio, I retained a small portion of my previous account to scratch my itch of trading with the goal of still outperforming the S&P500 by a large margin. I also have my Roth IRA for retirement.

Here’s the screenshots of my investment performance:

I plan to do this reviews every year. Hopefully I will be consistent on tracking my investment performance in the years to come.